Are you enrolled in Original Medicare in Texas and looking for a way to have more predictable costs? A Medicare Supplement insurance plan, also known as Medigap, could help pay for some or all out-of-pocket costs required under Original Medicare Parts A and B. Continue reading to learn about Medicare Supplement Plan G in Texas.

There are 10 types of Medicare Supplement plans in Texas. These plans are labeled A – G and K – N. Because Original Medicare doesn’t have an out-of-pocket maximum, 40% of Medicare enrollees had a Medicare Supplement plan to reduce the financial risks and expand their Medicare coverage.

Medicare Supplement Plan G, like the other plans, is offered by private insurance companies that are licensed by the Texas Department of Insurance.

Of the 10 types of Medicare Supplement plans available in Texas, Plan G is the most popular plan for new Medicare beneficiaries. Plan F (41.6%) is the second most popular plan in the state; however, that plan is not accepting new enrollments. The only way to have Plan F is if you became eligible for Medicare on or before January 1, 2020.

44.7% of Medicare Supplement plan enrollees in Texas have Plan G. Plan G is the closest that a new Medicare enrollee can get to Plan F, which is likely why Plan G enrollment increased from 35% (2019) to 41% (2020), and 44.7% (2021).

You are eligible for Medicare Supplement Plan G in Texas if you are enrolled in Original Medicare Part A and Medicare Part B and live in the plan’s service area.

Yes, Medicare Supplement Plan G is available in Texas and is, by many, the best Medicare Supplement plan in Texas. Texas has a standard Plan G and a High-Deductible Plan G option. The first is a comprehensive plan option, while the other is budget-conscious. Each plan provides the same Medicare benefits; however, the High-Deductible Plan G option has a higher annual deductible and a lower monthly premium.

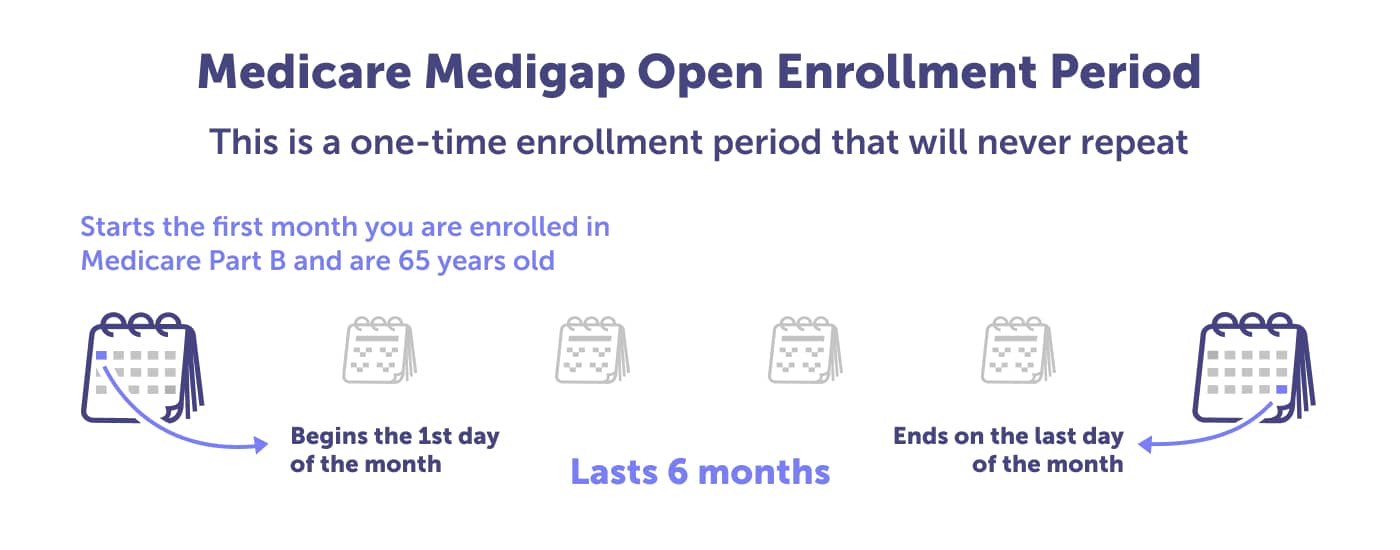

The ideal time to enroll in Medicare Supplement Plan G is during your Medigap Open Enrollment Period. During this period, insurance companies must sell you any plan they offer regardless of pre-existing medical conditions. The Medigap Open Enrollment Period is also when you receive the best pricing.

Agent tip:

“You should mark your Medigap Open Enrollment Period on your calendar. The bottom line is that you cannot be denied, and you’ll receive the best rate possible during your Medigap Open Enrollment Period.“

The Medigap Open Enrollment Period is unique to you. This enrollment period begins the first month you are enrolled in Medicare Part B, and you’re older than 65. The enrollment period lasts six months.

You mustn’t miss this enrollment period if you want to enroll in a Medicare Supplement plan. Unfortunately, this enrollment period only happens once and cannot be changed or repeated.

Should you miss your Medigap Open Enrollment Period, the insurance company may require underwriting to consider accepting your policy.

During this process, they’ll consider any pre-existing or current health conditions. They can refuse to insure you, and if they decide to provide a policy after the underwriting process, your policy could cost a lot more.

There are some situations where you can receive the same rights outside your Medigap Open Enrollment Period.

These include:

Medicare Supplement Plan G does not provide prescription drug coverage – and you must have creditable coverage under the federal Medicare program. In addition to signing up for Plan G, you should also enroll in the Medicare Part D standalone prescription drug plan if you don’t have creditable coverage from another source. If you don’t, you could face lifetime penalties once you sign up for prescription drug coverage.

Medicare Supplement Plan G covers the following:

Each Medicare Plan G provider offers different levels of covered services. You should check what plans cover and their costs as you compare plans.

If you have particular benefits that are important to you, share that information with a local licensed agent who can find the best plan options for you. Speak with a local Medicare agent at (623) 223-8884 or review your Medicare plan options online.

Availability and cost are essential factors in determining whether the standard or high-deductible plan is best for you. Because both plans provide the same benefits, you’ll need to assess whether you can afford a high-annual deductible and whether that will give enough savings compared to the standard plan’s higher monthly premiums.

The standard Medicare Plan G has higher monthly premiums than the High-Deductible Plan G. But the High-Deductible Plan G has lower premiums, with a higher overall plan deductible. What is most important to your health and budget?

The tables below compare a 65-year-old man who does and doesn’t smoke against a 65-year-old woman who does and doesn’t smoke. Here, you can review the premium differences between smokers and non-smokers and the sexes. Age also determines the plan’s cost, so please use this as an example, not the truth, as rates change for many reasons.

Need help deciding if a standard Medicare Supplement Plan G or a High-Deductible Plan G is best for your health and budget? Speak with a local Medicare agent who can guide you through your options. Call (623) 223-8884 or review your Medicare plan options online.

There are 49 companies that provide Medicare Supplement Plan G policies in Texas. There are many options, but that’s good news for you. Each of these companies is competing for your business.

All you need to do is speak with a local licensed agent who can guide you through your Medicare journey. They can help identify the best company to get a policy from in your county.

There is no one-size-fits-all Plan G. The coverage is standardized, so if Plan G is the right coverage choice for your health, you’ll need to weigh your carrier options. Each insurance carrier offers varying extra benefits, and the monthly premiums or deductibles can vary.

To determine which Plan G insurance company is available in your county – and fits your needs – you should speak with a local licensed agent. They can review your plan options with you and help guide you through your Medicare journey. Speak with a local Medicare agent at (623) 223-8884 or review your Medicare plan options online.

2022 The State of Medicare Supplement Coverage.

Guaranteed issue rights.

How to compare Medigap policies.

Supplement Insurance (Medigap) plans in Texas.

The State of Medicare Supplement Coverage, 2023.

Read more by Jasmine Alberto

I am a Spanish-speaking Texas Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2007. I am on the the Advisory Committee for Foster Grandparents, Senior Companions, and RSVP Houston. I enjoy traveling, a backyard BBQ, and volunteering in my community.