A Medicare Advantage plan, or a Part C plan, is an alternative to Original Medicare in Florida (Parts A and B). These plans are offered by private insurance companies and approved by the Centers for Medicare and Medicaid Services (CMS). They cover everything Original Medicare covers, plus additional benefits like routine dental and vision care. Approximately 55% of Floridians were enrolled in a Medicare Advantage plan in 2025.

To be eligible for Medicare Advantage in Florida, you must enroll in and be eligible for Part A (hospital insurance) and Part B (medical insurance) of Original Medicare. You must also live in the plan’s service area since Medicare Advantage plans are specific to the county you reside within.

As someone eligible for Medicare and living in Florida, you may wonder what the most popular types of Medicare Advantage insurance plans are. After all, with so many plans available, it can be tough to decide which one is right for you. To help you out, we’ve compiled a list of the five most popular Medicare Advantage plan types in the Sunshine State.

1. Health Maintenance Organizations (HMOs)

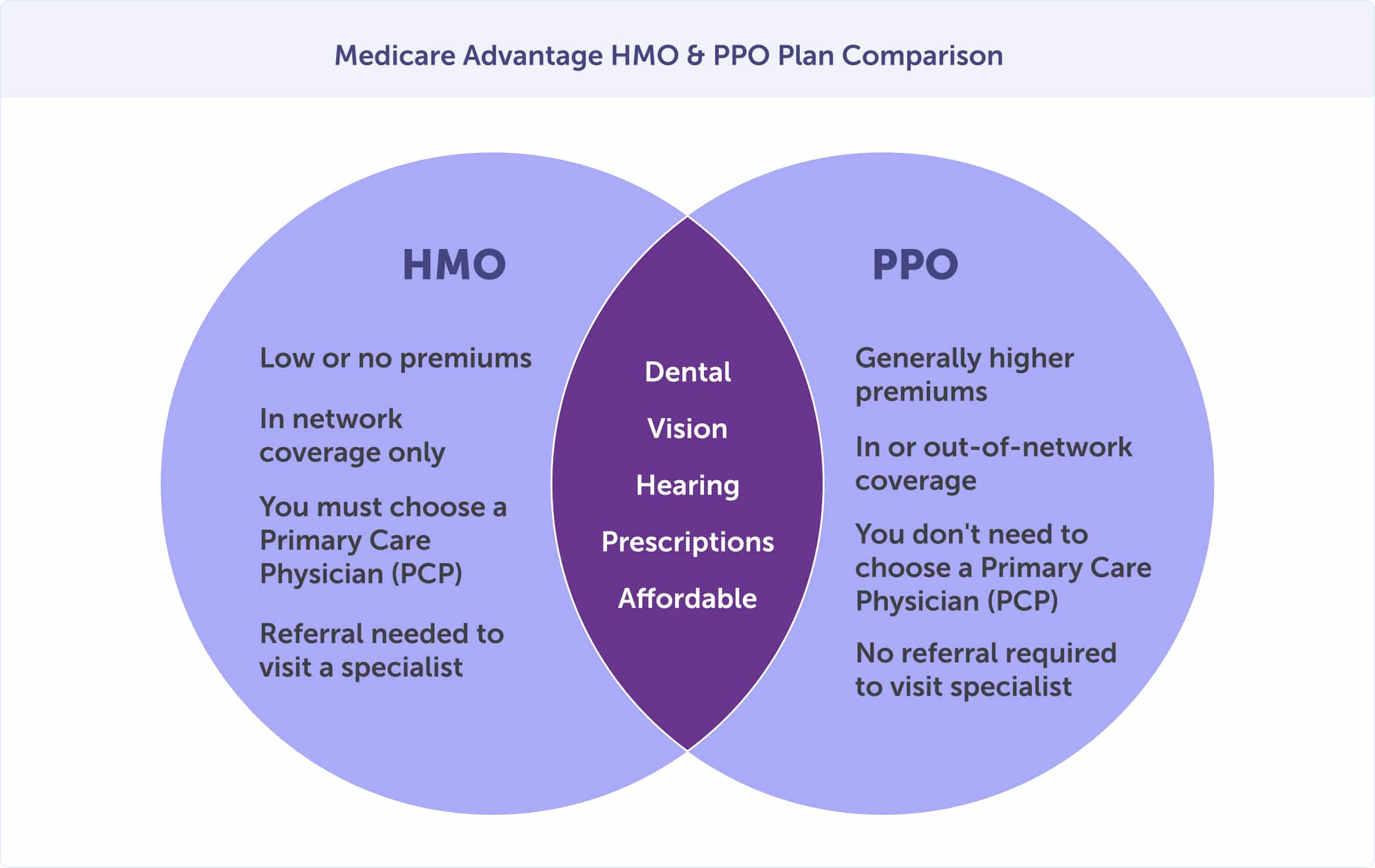

One of the most popular types of Medicare Advantage plans is the Health Maintenance Organization, or HMO. HMOs typically offer lower premiums than other types of plans, and they often have a network of doctors and hospitals that members must use. However, it’s important to note that HMOs typically require members to see doctors within their network for most services.

2. Preferred Provider Organizations (PPOs)

Preferred Provider Organizations, or PPOs, are another popular type of Medicare Advantage plan. Like HMOs, PPOs also have networks of participating doctors and hospitals. However, unlike HMOs, PPOs typically allow members to see out-of-network providers without a referral, though doing so usually costs more money.

3. Private Fee-for-Service Plans (PFFS)

Private Fee-for-Service Plans (PFFS) are a type of Medicare Advantage plan that allows members to see any doctor or hospital that accepts the plan’s terms and conditions. One advantage of PFFS plans is that they typically don’t require members to get referrals from primary care physicians to see specialists.

4. Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are a Medicare Advantage plan designed for people with certain chronic conditions, such as diabetes or heart disease. SNPs usually offer tailored coverage and benefits to meet the unique needs of their enrollees.

5. Dual Eligible Special Needs Plans (D-SNPs)

Dual Eligible Special Needs Plans are a type of SNP that provides coordination of benefits for enrollees who are eligible for both Medicaid and Medicare. D-SNPs typically offer extra benefits and services beyond those offered by regular SNPs, such as transportation assistance or case management services.

There you have it—Florida’s five most popular types of Medicare Advantage insurance plans. Now that you know the five plan types, continue reading to learn about Florida’s most popular insurance providers and plans.

If you have any further questions about Medicare Advantage plans or other insurance coverage, please call and speak with an advisor. Call (623) 223-8884 (TTY: 711) to talk with a local licensed agent.

Agent tip:

“The best Medicare Advantage plan is the one that suits your unique needs. You’ll need to weigh plan benefits, network access, coverage, and cost, among other factors. A local licensed agent can help you make an informed decision.“

Not all Medicare Advantage plans are offered in your area. Plan availability is based on the county that you live in. However, in Florida, five Medicare Advantage insurance providers are enrolling the most people.

These are the five most popular insurance providers:

We’ve selected nine counties and ranked the most popular plans based on enrollment numbers to show you how much plan options and popularity differ by county.

Live in Broward County, Hernando County, Hillsborough County, Lake County, Miami-Dade County, Orange County, Osceola County, Palm Beach County, or Seminole County? Below, you can preview the top five plans in those counties.

Broward County, Florida, residents are most likely to enroll in a Medicare Advantage HMO plan within one of these five plans. These are based on actual enrollment numbers for 2025.

In Hernando County, Florida, top Medicare Advantage plan enrollment lies mainly with HMO plans; however, there was one popular PPO plan. The top five Medicare Advantage plans for 2025 are:

In Hillsborough County, Florida, four of the five most popular plans are HMOs. The most popular plan plans in 2025 are:

In Lake County, Florida, Medicare Advantage plan enrollment was mixed between HMO and PPO plans. By enrollment, these are the top five plans in 2025:

In Miami-Dade County, Florida, enrollment in Medicare Advantage HMO plans is the most popular. The top five HMO plans by enrollment are:

Orange County, Florida, residents prefer to enroll in a Medicare Advantage HMO plan versus a PPO plan. Here are the top five most popular HMO plans in 2025:

In Osceola County, Florida, Medicare Advantage enrollment is the highest amongst HMO plans. Here are the top five plans, by enrollment, for 2025:

In Palm Beach County, Florida, Medicare Advantage enrollment is mixed between HMO and PPO plans. In 2025, the five most popular plans are:

In Seminole County, Florida, most residents enroll in a Medicare Advantage HMO plan; however, one PPO plan made the top five for enrollment. Discover the top five Medicare Advantage plans in 2025:

You should speak with a local licensed agent to determine the best Medicare Advantage plan in your county and for your health needs and budget. Call (623) 223-8884, and we’ll help you weigh your options.

In Florida, you can access a $0 premium Medicare Advantage plan. And these plans often come with dental, vision, hearing, and other extra benefits you can’t get with Original Medicare. The average cost of a Medicare Advantage plan is $9.41 in 2025.

When we surveyed the 2023 cost of Medicare Advantage plans amongst nine counties (Broward, Hernando, Hillsborough, Lake, Miami-Dade, Orange, Osceola, Palm Beach, Seminole), we found that the highest monthly premium you could pay was $111.00 per month for the HumanaChoice R5826-005 Regional PPO plan.

Costs vary based on county availability, benefits, and whether you prefer an HMO or PPO plan. All these variables, and more, will determine the cost and, ultimately, which plan is right for your health and budget.

A one-size-fits-all or “best” Medicare Advantage plan doesn’t exist. Your needs and circumstances are unique, and your plan should be tailored to you.

If there’s a source touting “the best” plan, they’re not looking out for your health and finances. Many factors will play into what the best Medicare Advantage plan in Florida means for you. The following section will explore considerations you should make before choosing a plan.

Choosing a Medicare Advantage Plan can be challenging, especially with all available options. However, choosing the right plan is essential to get the coverage you need. Here are a few things to consider when choosing a Medicare Advantage plan in Florida to make the best decision for your unique circumstances.

The first thing you’ll want to consider is what type of coverage you need from your Medicare Advantage Plan. There are three main types of Medicare Advantage Plans: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Private Fee-for-Service (PFFS) plans. Each type of plan has its strengths and weaknesses, so you must choose the right one for your unique situation.

Another important consideration is the plan’s cost. Before deciding, you’ll want to compare different plans’ monthly premiums, copayments, coinsurance, deductibles, and other out-of-pocket costs. It’s also important to understand what kind of Medicare coverage each plan offers to ensure you get good value for your money.

Choosing a Medicare Advantage Plan can be tricky, but it’s essential to take the time to find the right plan for your unique needs and situation.

When comparing Medicare Advantage plans, you should keep a few things in mind:

Deciding on the right Medicare Advantage plan doesn’t have to be overwhelming. Keep these things in mind as you compare plans, and you’ll be well on your way to finding the coverage that’s right for you.

Do you need help choosing the right Medicare Advantage plan for you? Call (623) 223-8884 to speak with a local licensed agent, and we’ll help you weigh your options.

The alternative to a Medicare Advantage plan is Original Medicare with a Part D prescription drug plan, plus a Medicare Supplement plan in Florida. This combination will provide Medicare Part A, B, and D coverage while protecting you against high out-of-pocket costs.

However, this combination is often not as budget-friendly as a Medicare Advantage plan and does not come with extra benefits such as dental, vision, hearing, and more.

A local licensed agent can help you weigh your plan options. Call (623) 223-8884 to discover which plan is the right fit for your health and budget.

MA Enrollment by SCC, February 2023.

MA State/County Penetration – February 2023.

Last updated: March 3, 2023

While there are popular plans in each county, there isn’t a one-size-fits-all best Medicare Advantage plan in Florida.

Instead, your Medicare Advantage plan should be tailored to your unique health and budget needs. When choosing a plan, consider the network, whether your doctors and specialists are in network, prescription drug coverage, out-of-pocket costs, the monthly premium, and more.

There are five Medicare insurance providers that enroll the highest number of Medicare-eligible people. You may choose learn more about plans from Humana, UnitedHealthcare, Aetna, BlueCross BlueShield (Florida Blue), and Sunshine State Health Plan.

Read more by William Revuelta

I am a Spanish-speaking Florida Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2009. I’m an avid sports fan and enjoy watching international soccer matches and college football. When not with my family, I listen to podcasts ranging from history to sports talk.