Florida Medicare plans include Part A, B, C, D, and Medicare Supplement coverage. Discover the differences between each plan, plus the essential enrollment deadlines you don’t want to miss.

Medicare is a United States federal health insurance program designed to provide and reduce the cost of healthcare services. There are criteria to qualify for Medicare in Florida and the rest of the country.

You are eligible for Medicare if you meet one of three criteria:

If you meet one of the above criteria, you qualify for Medicare and can apply. Keep reading to learn more about your Medicare plan options in Florida, enrollment periods you shouldn’t miss, and how to find coverage that fits your health and budget needs.

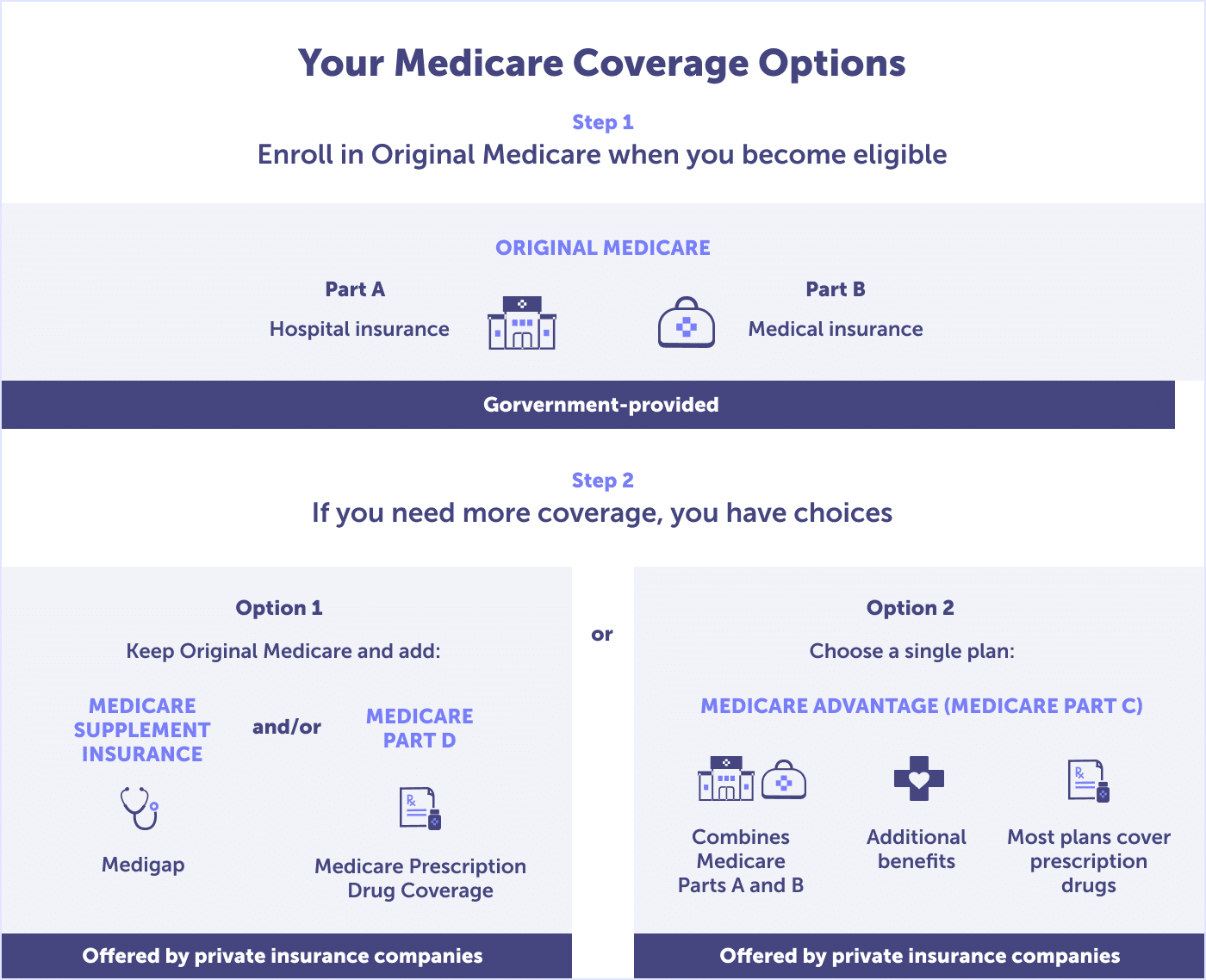

Floridians have public and private Medicare plan options. The public option provided by the federal government is referred to as Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance).

Because of Original Medicare’s limitations in protecting against out-of-pocket costs and a lack of coverage for dental, hearing, and vision, most people also have a private health plan approved by Medicare. These plans include Medicare Part C (Medicare Advantage plans), Medicare Part D (Prescription Drug Coverage), and Medicare Supplement plans (Medigap).

In the following sections, we’ll dive into what each of these plans covers so you can find the right combination for your needs.

Medicare Part A is your hospital insurance. It is one part of Original Medicare and is, in most cases, premium-free.

It covers but is not limited to the care you receive in the following settings:

While private Medicare plans that contract with the Centers for Medicare and Medicaid (CMS) may have different rules, the plan must provide at least the same coverage as Original Medicare Part A.

Medicare Part B is the second part of Original Medicare. It is your medical insurance. If you are eligible for Medicare Part A, you can enroll in Medicare Part B. Medicare Part B is not premium-free. You can expect to pay a monthly or quarterly premium for Medicare Part B.

The premium is standardized for Florida and the rest of the country because it’s based on your or your spouse’s income history – not your zip code or state.

Your income determines the cost of your premium. So, if your income fluctuates or you make over a certain amount, you may need to pay an Income Related Monthly Adjustment Amount (IRMAA) in addition to your premium.

In addition to your premium, you’ll have out-of-pocket costs. This includes an annual deductible ($257 in 2025) and coinsurance. Medicare Part B covers about 80% of costs, with 20% your responsibility. Original Medicare does not have a cap on out-of-pocket expenses.

Agent tip:

“Be sure to enroll in Medicare Part B during your Initial Enrollment Period. If you wait, you could experience a lifetime late enrollment penalty that is in addition to your standard premium and any IRMAA.“

Medicare Part B covers but is not limited to your basic medical needs, including:

55% of Floridians are enrolled in a Medicare Advantage plan in Florida. Medicare Advantage (MA) plans, or Medicare Part C, are an alternative to Original Medicare (Medicare Part A and B). Medicare Advantage plans are offered by private insurance companies that contract with the Centers for Medicare & Medicaid Services (CMS).

To qualify for a Medicare Advantage plan in Florida, you must be enrolled in Medicare Part A and B, plus live in the plan’s service area.

Medicare Advantage plans are required to match the coverage offered by Original Medicare Parts A and B. Unlike Original Medicare, Medicare Advantage plans set their deductibles, coinsurance, and copays within limits established by the federal government.

This means that you would limit out-of-pocket spending with a Medicare Advantage plan. Once you hit your out-of-pocket limit, including the deductible, the Medicare Advantage plan would pay 100% of covered healthcare costs for the remainder of the year. Original Medicare doesn’t have a cap on out-of-pocket expenses.

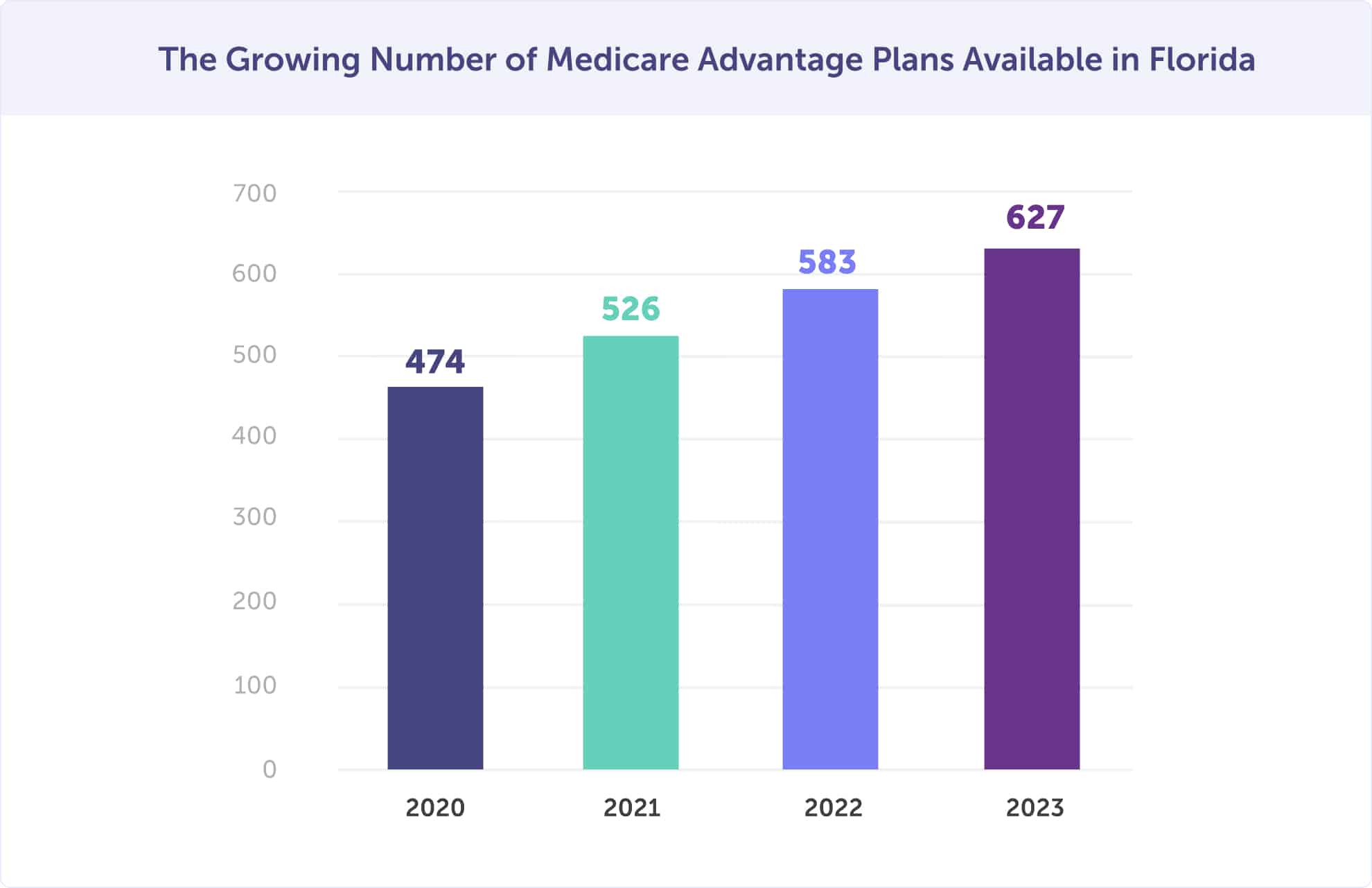

Medicare Advantage plans are local to the county level, and there are many options for you to choose from. In 2025, there are 627 Medicare Advantage plans available. This is a 7.5% increase between 2022 and 2023. There were 583 plans available in 2022, 526 in 2021, and 474 in 2020. Now, there are even more ways to find a plan that’s right for your health and budget.

Most of these plans offer innovative benefits like wellness and healthcare planning, reduced cost-sharing, rewards, and incentive programs, and routine dental, hearing, and vision. Many Medicare Advantage plans include prescription drug coverage. These plans are called Medicare Advantage Prescription Drug plans (MAPD). Medicare Advantage Prescription Drug plans provide the convenience of having your medical and prescription drugs through one plan.

Wondering if a Medicare Advantage plan is right for you? Speak with a local licensed agent to weigh your options. Call (623) 223-8884 today.

The Centers for Medicare and Medicaid Services (CMS) requires prescription drug coverage. You could face penalties if you don’t have creditable coverage when you first sign-up for Medicare Part A and B. To have creditable coverage, you’ll likely need to enroll in either a Medicare Advantage Prescription Drug plan or a standalone prescription drug plan, also known as Medicare Part D.

Medicare Part D is a federal government program that offers Medicare eligibles prescription drug coverage, whether you live in Florida – or elsewhere. Part D is provided by private insurance companies that contract with the Centers for Medicare and Medicaid Services (CMS)—similar to Medicare Advantage plans.

Medicare Part D works with Original Medicare Parts A & B. If you have a Medicare Advantage plan, you would likely get prescription coverage through a Medicare Advantage Prescription Drug plan (MAPD). You can have either an MAPD or Medicare Part D, but you cannot have both.

The cost and availability of a stand-alone Medicare Part D Prescription Drug plan will vary by county. Most plans require paying a monthly premium, annual deductible, and copayments or coinsurance.

If you have difficulty affording Part D or your prescription drugs, you may qualify for financial assistance through Extra Help. In 2025, 27% of Floridians with a Medicare Part D plan get Extra Help (the low-income subsidy).

Let Connie Health help ensure your Medicare plan covers the prescriptions you need. Or speak with one of our local licensed agents at (623) 223-8884 to see if you qualify for Extra Help paying for your prescriptions.

The Centers for Medicare & Medicaid (CMS) requires that you have creditable prescription drug coverage. You can get this through a Medicare Part D or Medicare Advantage Prescription Drug Plan. If you don’t have either of these choices, you must have it through another source, like group health insurance coverage.

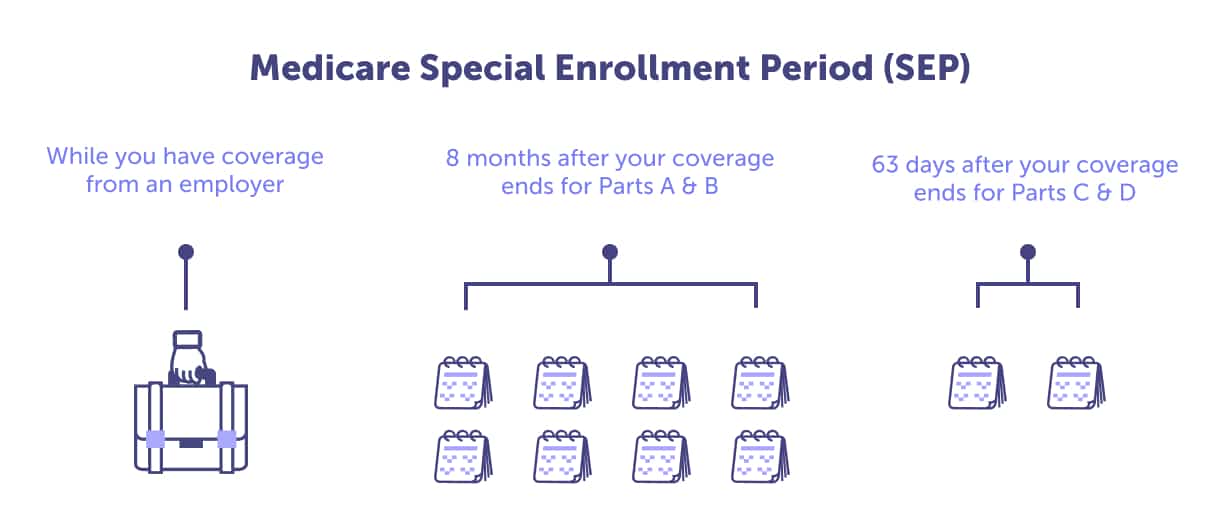

If you don’t have creditable coverage, you could incur a permanent late enrollment penalty when purchasing coverage. The penalty would be in place for the entire length of coverage. Avoid late penalties by enrolling in prescription drug coverage during your Initial Enrollment Period. And, if you have creditable group health insurance coverage but lose it, enroll in Medicare Part D or a Medicare Advantage Prescription Drug plan within 63 days of losing coverage.

Medicare Supplement plans, also known as Medigap, are provided by private insurance companies licensed by the Florida Office of Insurance Regulation and are authorized to sell Medigap plans.

Because Medicare Part A and B don’t have a maximum for out-of-pocket costs, you risk paying an unknown amount for your care. Medicare Supplement plans in Florida may reduce what you pay out-of-pocket for Original Medicare Part A and B services. Out-of-pocket costs include copays, deductibles, coinsurance, and, in some instances, emergencies that occur during international travel.

Most enrollees have supplemental coverage through a Medigap plan or a Medicare Advantage plan. These plans help reduce out-of-pocket costs because they have an annual out-of-pocket maximum.

Florida Medicare Supplement plans include plans A, B, C, D, F, G, K, L, M, and N. Each plan provides different coverage levels, and the carrier determines the cost. Medicare Supplement plans in Florida may include additional benefits such as a gym membership, hearing, and dental discounts.

You can purchase a Medicare Supplement plan during your Initial Enrollment Period. If you miss that, then you may not be able to enroll in a Medicare Supplement policy at the same rate – or at all.

Speak with a local licensed agent at (623) 223-8884 or use our plan finder to review Medicare Supplement plan options in Florida.

There are several enrollment deadlines that you should mark on your calendar. Some happen once, while others are recurring. Knowing when each happens and the changes you can make can save you money. Continue reading to learn about your enrollment periods.

Most Floridians get Medicare Part A and Medicare Part B when they first become eligible for Medicare during their Initial Enrollment Period. This period begins three months before your 65th birthday, the month of your birthday, and ends three months after you turn 65. In total, it’s a seven-month enrollment period.

If you are not collecting Social Security benefits before your Initial Enrollment Period starts, you must sign up for Medicare online or contact the Social Security Administration.

This enrollment period is essential because if you don’t sign up for Part B, you could face a penalty. This penalty would be added to your Part B premium and last the entire time you have Part B. The longer you wait to sign up for Part B, the more costly the penalty becomes.

If you miss your Initial Enrollment Period, you may be eligible to enroll during the General Enrollment Period or a Special Enrollment Period if you qualify.

Unsure whether now is the right time to enroll in Medicare Part B? Speak with a local licensed Medicare agent to explore your options. Call (623) 223-8884.

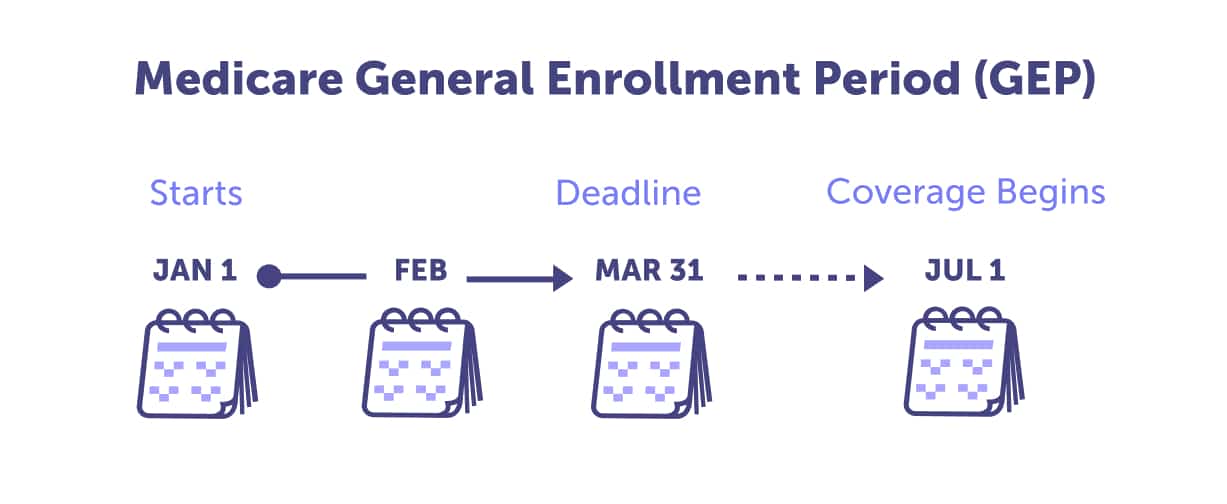

If you miss your Initial Enrollment Period, the next best time to sign up for Medicare Part A and B is the General Enrollment Period. The General Enrollment Period is from January 1 through March 31 annually. You can enroll during this time, and your coverage will begin on July 1st.

Enrolling during the General Enrollment Period may mean you will incur Medicare Part B late enrollment penalties.

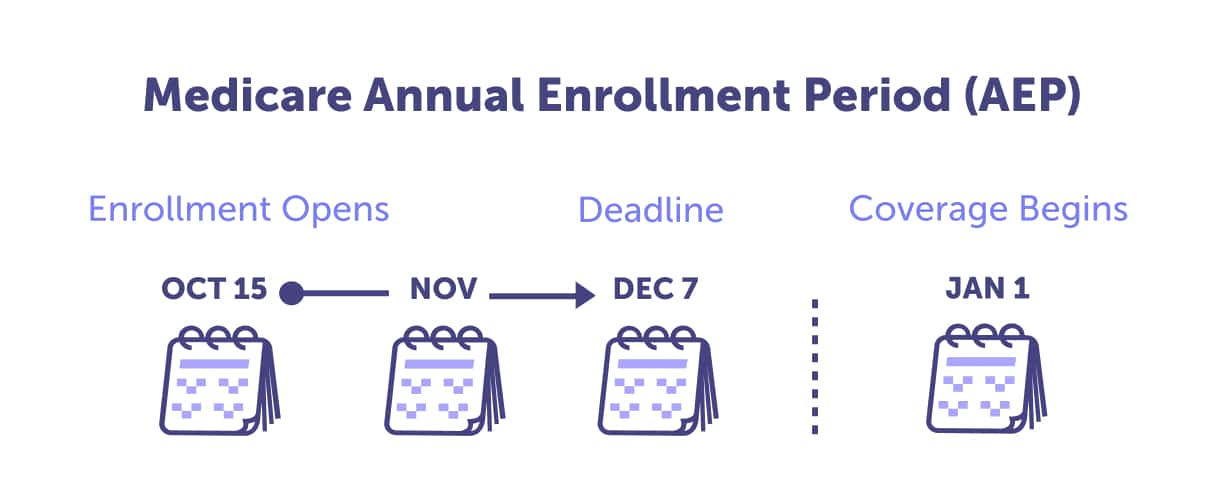

The Medicare Annual Enrollment Period is for people already enrolled in Medicare Part A and B. This period runs from October 15 through December 7 annually. You can join a Medicare Advantage plan or make other plan changes during this time.

We recommend that everyone does a Medicare plan review during the Annual Enrollment Period. Because plans change every year and new plans become available, you may be able to find an option that better suits your health and budget. Read our Ultimate Guide: The Medicare Annual Enrollment Period to learn how to prepare for this crucial enrollment period.

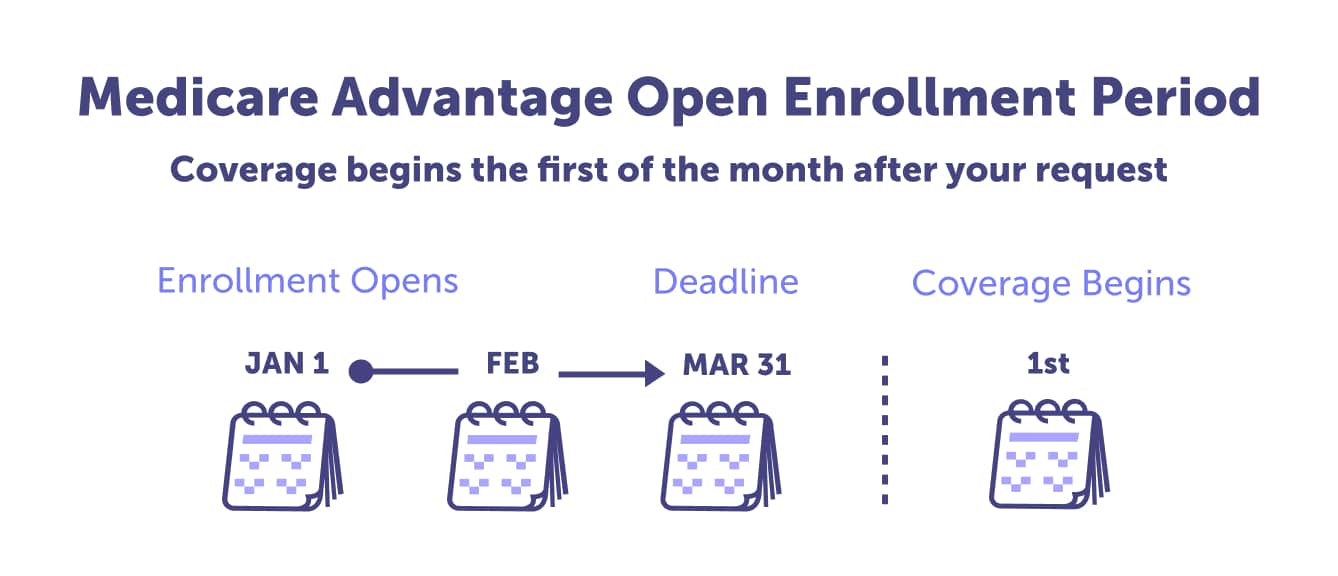

The Medicare Advantage Open Enrollment Period occurs annually from January 1 through March 31. It coincides with the General Enrollment Period. During this time, you can change Medicare Advantage plans, among other plan changes. New plan coverage would begin the first of the month following your plan change request.

You must qualify for a Medicare Special Enrollment Period. There are circumstances, including moving, losing your coverage, or the chance to get other coverage, among other reasons, that would enable you to make a plan change outside of other enrollment periods.

Have a local licensed agent review your enrollment periods and plan options in Florida. Call (623) 223-8884 to speak with an agent or review plan options online.

Apply for Medicare Part D Extra Help program.

MA State/County Penetration – February 2023.

Medicare Open Enrollment in Florida, 2023.

Last updated: March 2, 2023

Read more by William Revuelta

I am a Spanish-speaking Florida Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2009. I’m an avid sports fan and enjoy watching international soccer matches and college football. When not with my family, I listen to podcasts ranging from history to sports talk.