Medicare Advantage plans, or Medicare Part C, are increasingly popular.

Many Medicare beneficiaries select these plans because they appreciate the convenience of health and drug benefits under one plan at predictable prices, as well as other benefits such as dental, vision, hearing, and gym memberships.

Let’s explore the Medicare Advantage plan, how it works, and who’s eligible. By the end, you’ll better understand whether a Medicare Advantage plan is right for you.

Medicare Advantage plans, sometimes called “Part C” or “MA plans,” are an “all-in-one” alternative to Original Medicare. They are offered by private insurance companies and regulated by the Centers for Medicare & Medicaid Services (CMS).

With Medicare Part C, you get all the benefits and coverage of Medicare Part A and B plus extra benefits. Don’t worry; you’re never sacrificing Original coverage. These “bundled plans” include Medicare Part A (hospital insurance) and Medicare Part B (medical insurance), and usually Medicare Prescription Drug Coverage (Medicare Part D).

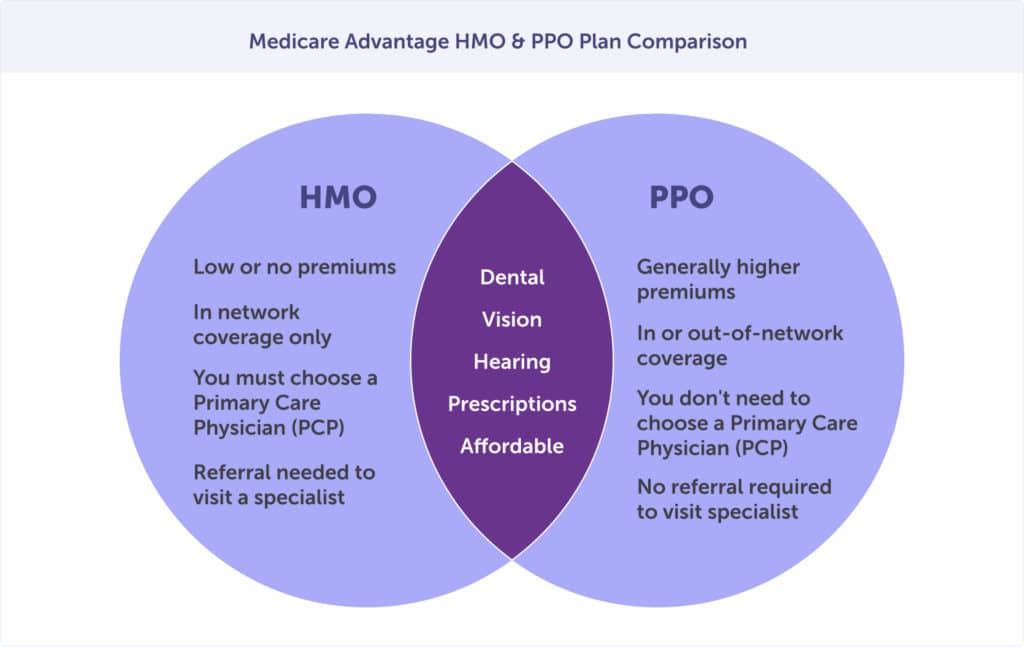

A frequently asked question about Medicare is: “What doctors and facilities will I be able to use?” You are comfortable with them, you trust them, and they are convenient for you. Therefore, it’s essential to understand the primary types of Medicare Advantage plans – and how access to doctors differ:

In a Medicare Advantage HMO, you can only use in-network providers. An in-network provider is a doctor contracted by an insurance company, usually found within a specified list. In most cases, a referral from your primary care doctor is also required to see a specialist. You are also required to use network hospitals and medical facilities. Not all plan networks include all hospitals.

If you belong to a Medicare Advantage PPO, you can see both in-network and out-of-network specialists and doctors without needing a referral from your primary care physician. Be prepared; if you visit an out-of-network doctor, you usually pay more than an in-network doctor.

Are you unsure if an HMO or PPO Medicare Advantage plan is best for you? A local Connie Health agent can help you weigh the pros and cons. Call (623) 223-8884 to speak with a licensed agent in your community.

So, what are the advantages of Medicare Advantage? One of the biggest is that many plans offer additional benefits beyond Original Medicare, such as comprehensive dental, vision, and hearing services. Some plans have lower out-of-pocket costs than Original Medicare, while others may include prescription drug coverage.

Agent tip:

“Medicare Advantage plans offer financial peace of mind because they cap your annual out-of-pocket expenses. Original Medicare does not.“

While the benefits are phenomenal and not offered by Original Medicare, one of the biggest reasons people choose a Medicare Advantage plan is because it caps their out-of-pocket expenses.

With Original Medicare, you pay a deductible and coinsurance – and the coinsurance is an unlimited amount without a cap. That means you could be in grave financial danger if a significant injury or illness occurs. A Medicare Advantage plan has a cap, so you know your annual maximum out-of-pocket. This provides great peace of mind.

The first cost people often consider is the monthly premium. Medicare Advantage plan premiums start at $0, depending on plan benefits and location. The low or no premium is one of the most substantial benefits of Medicare Advantage plans. Remember that you will likely have to pay your Medicare Part B premium, so figure that into your costs.

With Medicare Advantage plans, you will be charged a copayment or coinsurance for any service you use. These amounts differ; some plans even have a $0 copay to see your primary care doctor or specialist.

This is the maximum amount you will pay out-of-pocket in a given plan year. Some costs do not count towards the out-of-pocket maximum, including premiums, Part D prescription drug costs, services not covered by the plan, and some charges from out-of-network providers. Once you reach your out-of-pocket maximum, the insurance plan pays for services for the remainder of the plan year.

Some plans have a deductible, which you pay for medical or prescription drugs before your insurance begins to pay for coverage. Many plans do not have any deductibles. If you want a plan without a deductible, let your agent know so they can find one that suits your budget.

Medicare Advantage plans typically include Part D prescription drug coverage. Some Medicare Advantage plans, or Medicare Savings or Cost Plans, do not include Part D coverage. You must also purchase a stand-alone Part D prescription drug plan (PDP) from a private insurance company in those cases.

Enrolling for your Medicare drug coverage during your Initial Enrollment Period is essential. You may be subject to an enrollment penalty if you don’t enroll for Medicare drug coverage during your initial eligibility period.

Most Medicare Part D or Medicare Advantage plans with drug coverage have a tiered structure, called a formulary, to determine what you pay for prescription drugs. To minimize drug costs, look for a plan covering your medications in more favorable tiers.

Additionally, the pharmacy where you purchase your medication impacts how much you will pay. Insurance companies divide pharmacies into “preferred” and “standard.” In general, “preferred” pharmacies offer more cost-effective prescription drug options.

Who’s eligible for Medicare Advantage? Anyone eligible for Medicare Part A and Part B can enroll in a Medicare Advantage plan. Medicare Advantage plans are based on your county, so you must enroll in a plan available in your county.

The best time to enroll in a Medicare Advantage plan is during your Initial Enrollment Period. This enrollment period begins three months before you turn 65, the month of your birthday, and three months after. It’s a total of 7 months.

If you miss this enrollment period, the second best is the General Enrollment Period. However, if you enroll during this time, you will likely face lifetime late enrollment penalties.

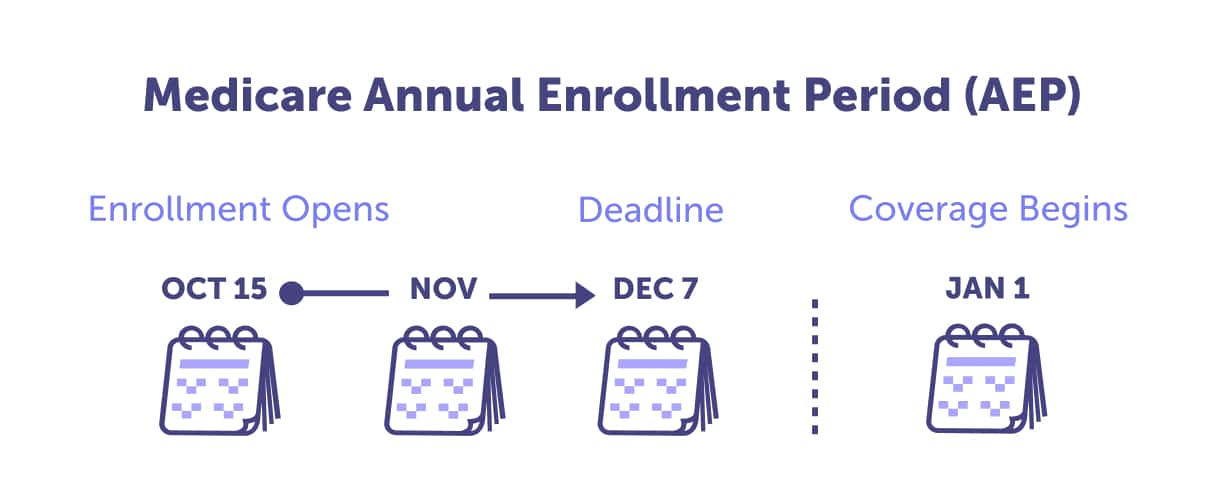

If you want to make a Medicare Advantage plan change, it is two times annually—first, the Annual Enrollment Period. Between October 15 – December 7 is when you should meet with your agent, review your Medicare plans, and ensure they’re the best plan for your health and budget in the coming year.

The other time is the Medicare Advantage Open Enrollment Period. This is a three-month period annually (January 1 – March 31) when you can only change a Medicare Advantage plan.

A Medicare Advantage is a viable alternative to Original Medicare, with its own set of benefits. If you’re considering enrolling in a Medicare Advantage plan, it’s essential to carefully review the plan’s rules and restrictions and your own healthcare needs and preferences. Doing so lets you decide which type of Medicare coverage is right for you.

If you’re interested in joining a Medicare Advantage plan or have questions about Medicare health plans, a Connie Health agent can help. We’re here to support you throughout your Medicare journey—call (623) 223-8884 to speak with a licensed agent in your community.

Medicare Part C, also known as Medicare Advantage, is a health insurance plan offered by private insurance companies but regulated by the Centers for Medicare & Medicaid Services (CMS). This plan provides all the benefits of Medicare Part A and Part B, including additional benefits such as vision, dental, and hearing coverage. The point is to have all the benefits of Original Medicare and additional coverage under one plan.

Medicare Part C includes a cap on out-of-pocket expenses for medical coverage. This means seniors will no longer worry about significant medical bills. This feature is an excellent option for seniors who require frequent healthcare services or have a chronic health condition.

Seniors who choose Medicare Part C may have access to other benefits, such as health and wellness programs. These programs include exercise classes and nutrition counseling designed for seniors.

Private insurance companies approved by the Centers for Medicare & Medicaid (CMS) offer Medicare Part C. Part C provides all of the benefits of Parts A and B and includes additional benefits such as prescription drugs, dental, vision, and hearing coverage.

One of the benefits of Medicare Part C plans is that they often have lower out-of-pocket costs than Original Medicare. However, it’s crucial to remember that each plan has cost-sharing requirements, such as deductibles, copays, and coinsurance. Medicare Advantage Plans also have an out-of-pocket maximum, which means that once you spend a certain amount, your plan will cover all additional costs for the remainder of the plan year. That’s something Original Medicare doesn’t offer.

There are two primary reasons why you may need a Medicare Part C plan: cost savings and comprehensive services.

Cost Savings: One of the biggest advantages of Medicare Part C is cost savings. Unlike Original Medicare, Medicare Advantage plans typically have a cap on out-of-pocket expenses. This means that once you reach the limit, your plan covers all additional costs for covered services. Some Medicare Advantage plans even come with $0 monthly premiums, making healthcare more affordable for seniors on a fixed income.

Comprehensive Services: Medicare Part C offers comprehensive healthcare services beyond Original Medicare. It may cover dental, vision, hearing care, wellness programs, and fitness memberships. This is especially important for seniors needing more specialized care as they age.

There is no “best” Medicare Advantage plan because your plan should be tailored to your health and budget needs. There are ways to choose the best Medicare Advantage plan for you.

When choosing a Medicare Advantage plan, there are several factors to consider. These include cost, benefits, network coverage, healthcare services, and the insurance company’s reputation.

The Centers for Medicare & Medicaid Services (CMS) rates Medicare Advantage plans on a 5-star scale. This Rating system evaluates plans based on their quality and performance, with 1 star being the lowest and 5 stars the highest. The ratings consider several factors, such as customer service, the quality of care, management of chronic conditions, and the member experience.

A 5-star plan is considered excellent and is the highest achievable rating. Plans with at least 4 stars are often classified as high-performing or excellent. These ratings are updated annually, so they can help you make an informed decision when choosing your Medicare Advantage plan.

If you’d like assistance selecting a plan that fits your needs, contact a local licensed Connie Health agent who can guide you through the process. Your health and peace of mind are worth it! Call (623) 223-8884 to speak with a licensed agent in your community.

Aetna, owned by CVS Health, expects significant changes to its 2025 Medicare Advantage plans. It projects a 10% loss in membership as it refocuses on getting its business “back on track.”

According to CNN Health, about 36% of Medicare Advantage enrollees with drug coverage will see deductibles rise by at least $200. Aetna members are most affected, with maximum drug deductibles reaching $595.

Insurers are also scaling back dental, hearing, and vision benefits. On average, Aetna plans to reduce allowances by over $1,700 annually for its top 20 plans. Aetna is also trimming benefits for over-the-counter medicine and flexible spending cards.

Annual Medicare plan changes are why you must have your plan reviewed annually. You may find a plan that offers greater benefits at a lower cost. Call (623) 223-8884 and have your plan reviewed by a local licensed Connie Health agent.

Read more by David Luna

I am a Spanish-speaking Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2005. I am a Marine Corps Veteran & former police officer. I enjoy watching football and basketball but hold family time in the highest regard.