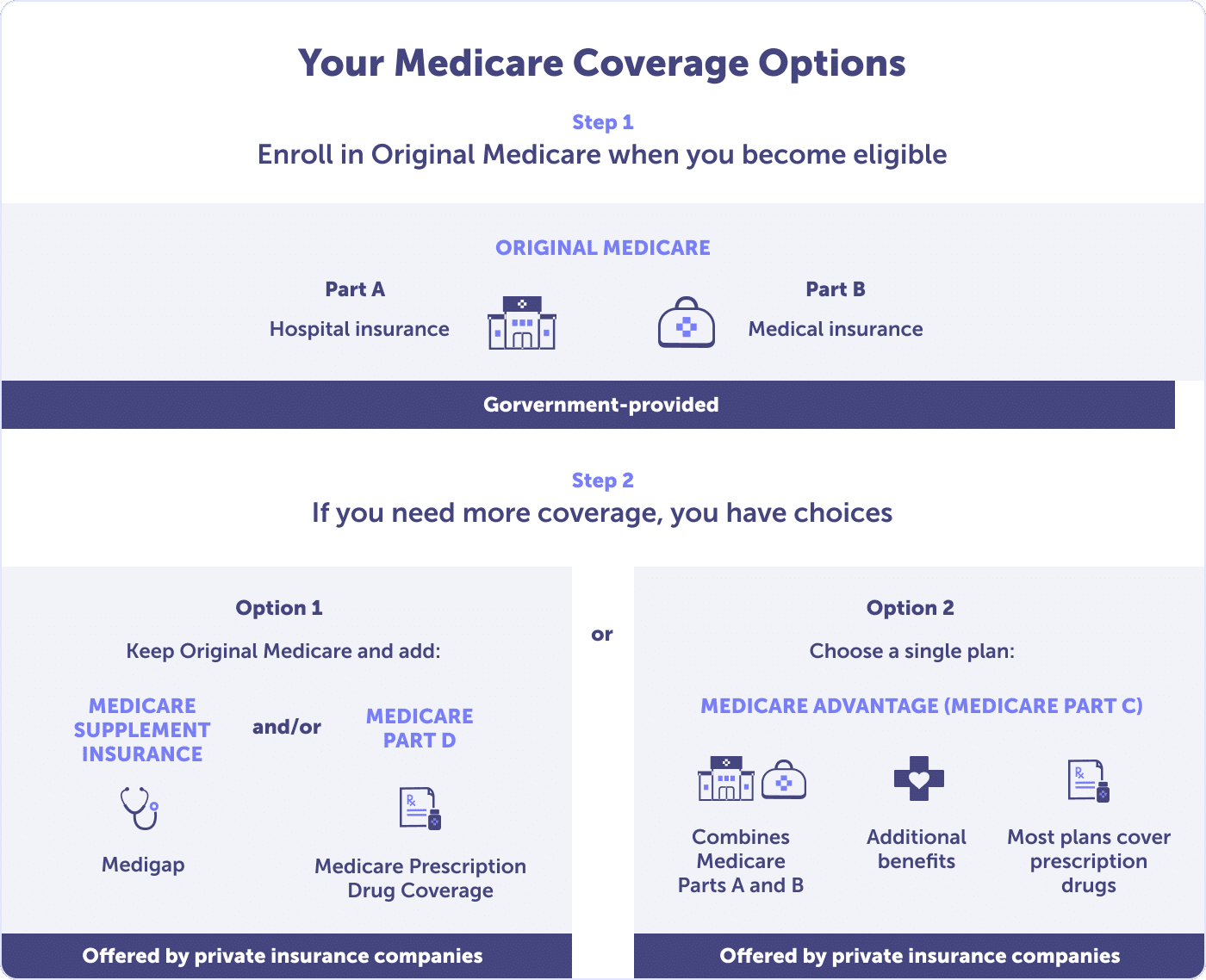

Once you turn 65 and enroll in Part A and B health insurance, you’ll discover that Original Medicare does not cap out-of-pocket costs. If you have a severe injury or illness, your Medicare expenses could skyrocket and place you in financial hardship. This is why most Medicare beneficiaries choose to expand their Medicare coverage and enroll in a Medicare Advantage or Medicare Supplement plan.

Medicare coverage is not cookie-cutter; it should be tailored to your health and budget needs. Because of this and the many different plans available, it can be challenging to determine which is best for your needs. In this article, we’ll explore the differences between Medicare Advantage and Medicare Supplement plans to help you make an informed decision.

Medicare Advantage, also known as Part C, is a comprehensive plan that combines all aspects of Original Medicare coverage, including preventative health (Medicare Part B), hospitalization (Medicare Part A), outpatient services, and, frequently, prescription drugs (Medicare Part D). It is offered by private insurance companies approved by the Centers for Medicare & Medicaid Services (CMS). These plans have a maximum out-of-pocket so that you can rest easy. Plus, the deductible, copayments, coinsurance, and premiums are set by insurance providers within limits set by CMS.

Medicare Advantage plans usually have lower premiums than Medicare Supplement plans. Some plans also offer extra benefits or incentives, such as dental, vision, hearing, or fitness programs. With a Medicare Advantage plan, you must keep your Part B and pay the Medicare Part B premium.

Agent tip:

“Medicare Advantage plans offer benefits that you can’t get with Original Medicare or a Medicare Supplement plan. If you want comprehensive dental, vision, or hearing, a Medicare Advantage plan could be a good choice.“

Medicare Supplement, also known as a Medigap plan, covers the “gaps” in Original Medicare (Part A and B) coverage. These gaps include coinsurance, co-pays, deductibles, and other out-of-pocket expenses.

Private insurance companies sell Medicare Supplement insurance plans and offer standardized benefits across all plans, making it easier to compare and choose the right one for you. When you buy a Medigap plan, you must have creditable coverage from a Medicare Part D prescription drug plan or another source. If you don’t, you could face penalties.

The significant difference between Medicare Advantage and Medicare Supplement plans is the way they provide coverage, their cost, and flexibility. Medicare Advantage plans replace traditional Medicare coverage, whereas Medicare Supplement plans work alongside Original Medicare to help cover the gaps in coverage. Medicare Advantage plans usually have a more limited network of healthcare providers, while Medicare Supplement plans allow you to see any healthcare provider (doctors or hospitals) who accepts Medicare assignment.

Choosing between Medicare Advantage and Medicare Supplement plans depends on your individual healthcare needs and budget. If you’re generally healthy and don’t need regular medical care, a Medicare Advantage plan might be a good choice for you. On the other hand, if you have healthcare needs requiring regular doctor and specialist visits, a Medicare Supplement plan might be a better fit since it covers the gaps in traditional Medicare coverage.

When choosing between Medicare Advantage and Medicare Supplement, you should consider your preferred doctors, specialists, and hospital networks. Some don’t accept Medicare Advantage plans. If that’s the case, choosing a Medicare Supplement plan may be better for your health.

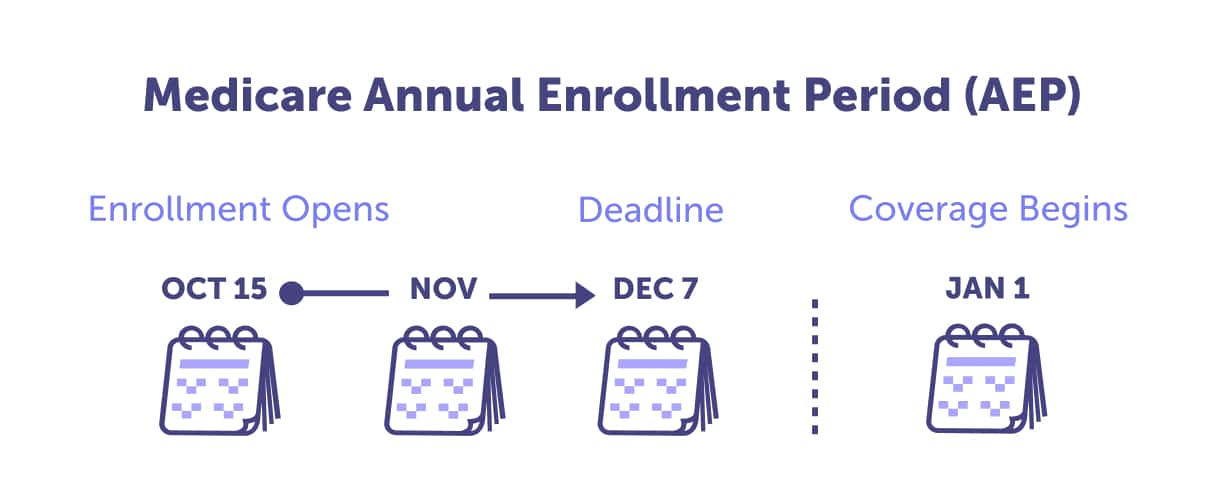

When choosing between Medicare Advantage and Medicare Supplement plans, it’s essential to compare each plan’s costs, benefits, and restrictions. Consider your current healthcare needs, budget, and prescription medications when deciding which plan best fits you. Remember to review your plan annually during the Annual Enrollment Period to ensure it still meets your needs as your health changes.

You have options when it comes to your Medicare coverage. With the right Medicare plan, you can have peace of mind knowing that your healthcare needs are covered.

Still unsure if a Medicare Advantage or Medicare Supplement plan will work best for you? A local licensed Connie Health agent can help. We’ll help you weigh the pros and cons and share plan choices tailored to you—call (623) 223-8884 to speak with an agent in your community.

Read more by David Luna

I am a Spanish-speaking Arizona Life and Health Insurance Licensed Agent and have been helping people with Medicare since 2005. I am a Marine Corps Veteran & former police officer. I enjoy watching football and basketball but hold family time in the highest regard.